CommScope CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in infrastructure solutions for communications networks, reported results for the quarter and year ended December 31, 2019.

The company reported fourth quarter net sales of $2.30 billion, an increase of 117.3% compared to $1.06 billion during the same period in the prior year. Fourth quarter 2019 included sales of $1.33 billion from ARRIS, which was acquired on April 4, 2019. ARRIS sales in the fourth quarter included a $13.2 million reduction related to deferred revenue purchase accounting adjustments.

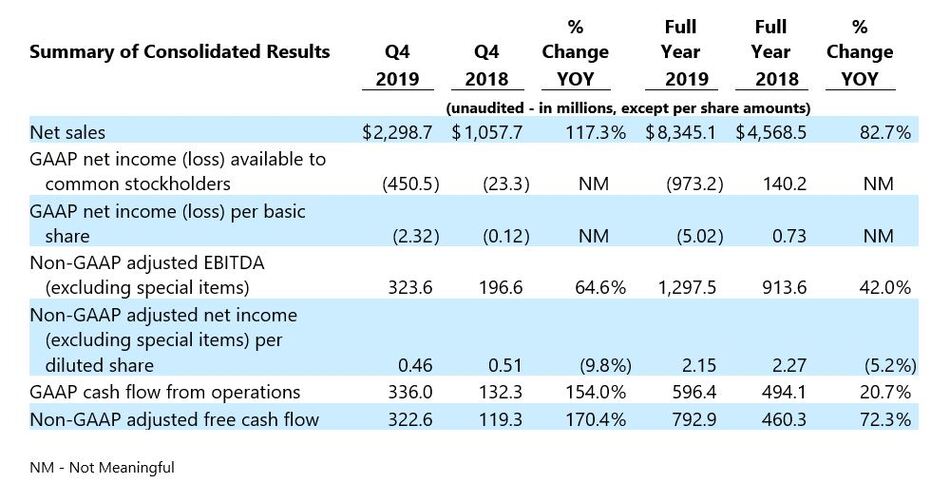

CommScope generated a net loss available to common stockholders of $(450.5) million, or $(2.32) per basic share, in the fourth quarter, a decrease from the prior year period's net loss of $(23.3) million, or $(0.12) per basic share. In the fourth quarter of 2019, we recorded $376.1 million of goodwill impairment charges related to our ARRIS reporting units as a result of our annual goodwill impairment test. Non-GAAP adjusted net income for the fourth quarter was $106.6 million, or $0.46 per diluted share, versus $99.8 million, or $0.51 per diluted share, in the fourth quarter of 2018. A summary of reported GAAP results and non-GAAP results is included below.

"We are pleased to finish 2019 on a high note, as we delivered net sales at the midpoint of our guidance, adjusted EBTIDA at the high-end of our targeted range, and adjusted EPS well above our targeted range,” said President and Chief Executive Officer Eddie Edwards.

Edwards continued, “Despite industry headwinds, our team remained focused on managing the elements we could control. Our strong operational discipline allowed us to generate significant cash flow, resulting in $300 million of early debt paydown in the fourth quarter and an additional $100 million paydown earlier this week. We are executing on our strategy and surpassing our cash flow and debt paydown expectations. As a result of our success, there is only $50 million principal remaining on our 2021 notes with the next nearest maturity not until 2024.

“Looking forward, 2020 will be a year of continued and active cost structure management while strategically investing in our business to position CommScope for accelerated growth. We remain confident in the long-term potential of our business and our ability to deliver significant shareholder value.”

Fourth Quarter 2019 Overview

For comparisons described below as combined company, the fourth quarter of 2018 includes historical ARRIS results (with certain classification changes to align to CommScope’s presentation). Reconciliations of the combined company amounts and reported GAAP results to non-GAAP and adjusted segment results are included below.

Net sales in the fourth quarter of 2019 increased 117.3% year over year to $2.30 billion primarily due to the contribution of $1.33 billion from the ARRIS acquisition.

On a combined company basis, net sales decreased 19.2% year over year to $2.30 billion, with lower results across all segments and geographic regions. The decrease was primarily due to lower sales to cable operators. Changes in foreign exchange rates negatively impacted net sales by less than 1%.

GAAP net loss available to common stockholders was $(450.5) million for the fourth quarter of 2019, driven by $376.1 million of goodwill impairment charges related to our ARRIS reporting units as a result of our annual goodwill impairment test. Since the closing of the acquisition of ARRIS, these reporting units have experienced challenges that impacted our performance, including declines in spending by cable operator customers that resulted in declines in net sales and operating income and the loss of key leaders following the acquisition. We initially anticipated a recovery in spending by certain customers starting in 2020; however, during our annual strategic planning process in the fourth quarter, a number of specific factors arose, including an assessment of historical and future operating results, key customer inputs, new assessments of market trends and anticipated expenditures required to support the changing market dynamics affecting each of the reporting units. As a result of these factors, we expect a more prolonged recovery and we concluded that the fair value of each of the ARRIS reporting units was less than its carrying value, resulting in the goodwill impairment charges. Goodwill impairment charges are excluded from non-GAAP adjusted EBITDA.

Non-GAAP adjusted EBITDA increased 64.6% to $323.6 million year over year. On a combined company basis, non-GAAP adjusted EBITDA for the fourth quarter of 2019 decreased by 18.4% and was 14.1% of net sales compared to 13.9% of net sales in the fourth quarter of 2018. Non-GAAP adjusted EBITDA was primarily impacted by lower sales, partially offset by lower material costs and lower operating expenses when compared to the year ago period for the combined company.

In the fourth quarter, the company generated GAAP cash flow from operations of $336.0 million. Non-GAAP adjusted free cash flow was $322.6 million after adjusting operating cash flow for $12.9 million of cash paid for restructuring costs and $5.5 million of cash paid for transaction and integration costs. Non-GAAP adjusted free cash flow reflects a $78.0 million benefit from certain payments that should have occurred in the fourth quarter of 2019 but were made in the first quarter of 2020.

The company ended the fourth quarter with $598.2 million in cash and cash equivalents. As of December 31, 2019, the company had no outstanding borrowings under its new asset-based revolving credit facility and had availability of $796.8 million, after giving effect to borrowing base limitations and outstanding letters of credit. The combination of cash and cash equivalents and undrawn credit facility capacity as of December 31, 2019 provided the company with total liquidity of approximately $1.4 billion.

During the fourth quarter the company redeemed $300 million aggregate principal amount of its 5.00% senior notes due 2021 (“the 2021 Notes”). Subsequent to the end of the fourth quarter of 2019, the company redeemed an additional $100 million aggregate principal amount of the 2021 Notes. Following the redemption, $50 million aggregate principal amount of the 2021 Notes remained outstanding.

Fourth Quarter Segment Overviews

For comparisons described below as combined company for the Customer Premises Equipment, Network and Cloud and Ruckus segments, the fourth quarter 2018 includes historical ARRIS results (with certain classification changes to align to CommScope’s presentation). Reconciliations of the combined company amounts and reported GAAP results to non-GAAP results are included below.

Connectivity Solutions

- Segment net sales of $605.9 million decreased 9.1% primarily due to lower sales volumes to cable operators and carriers. Changes in foreign exchange rates negatively impacted segment net sales by less than 1%. Net sales declined in all geographic regions.

- GAAP operating income of $28.9 million decreased 24.9%. Segment adjusted EBITDA decreased 32.3% to $91.2 million, or 15.1% of segment net sales, compared to 20.2% of segment net sales in the year ago period. Both GAAP operating income and segment adjusted EBITDA decreased primarily due to lower sales volumes.

Mobility Solutions

- Segment net sales of $365.6 million decreased 6.4% primarily due to a pause in spending related to the pending merger of two large telecommunications customers. Changes in foreign exchange rates negatively impacted segment net sales by less than 1%. Net sales declines in the Asia Pacific and CALA regions were partially offset by increases in the EMEA and the North America regions.

- GAAP operating income of $23.5 million increased 116.5% driven by lower impairments, restructuring charges, transaction and integration costs and intangible amortization expense, all of which are excluded from segment adjusted EBITDA. Segment adjusted EBITDA decreased 10.5% to $55.4 million, or 15.2% of segment net sales, a decrease of 70 basis points compared to the year ago period. Segment adjusted EBITDA decreased mainly due to pricing and lower sales volumes, partially offset by favorable mix and manufacturing cost reductions.

Customer Premises Equipment

- Segment net sales of $823.6 million decreased 25.1% from the year ago period on a combined company basis primarily due to reduced cable operator spending. Net sales in the quarter included a $1.3 million reduction of revenue related to deferred revenue purchase accounting adjustments. The impact of changes in foreign exchange rates was not significant to segment net sales. Net sales declined in the North America, CALA and EMEA regions, but these declines were slightly offset by increased sales in the Asia Pacific region.

- GAAP operating loss was $(174.8) million. GAAP operating loss was negatively impacted by a goodwill impairment charge of $192.8 million, which is excluded from segment adjusted EBITDA. Segment adjusted EBITDA increased 47.9% to $71.9 million, or 8.7% of segment net sales, compared to 4.4% of segment net sales in the year ago period on a combined company basis. Segment adjusted EBITDA increased despite lower net sales due to the benefits of lower material costs and cost containment efforts.

Network and Cloud

- Segment net sales of $366.1 million decreased 31.8% from the year ago period on a combined company basis primarily due to reduced cable operator spending. Net sales in the quarter included a $9.1 million reduction of revenue related to deferred revenue purchase accounting adjustments. The impact of changes in foreign exchange rates was not significant to segment net sales. Net sales declined in all geographic regions.

- GAAP operating loss was $(166.4) million. GAAP operating loss was negatively impacted by a goodwill impairment charge of $142.1 million, which is excluded from segment adjusted EBITDA. Segment adjusted EBITDA decreased 36.1% to $97.1 million, or 26.5% of segment net sales, compared to 28.3% of segment net sales in the year ago period on a combined company basis. Both GAAP operating loss and segment adjusted EBITDA were negatively impacted by lower sales, partially offset by cost synergies and favorable mix.

Ruckus

- Segment net sales of $137.5 million decreased 9.1% from the year ago period on a combined company basis primarily impacted by a reduction in service provider spend. Net sales in the quarter included a $2.8 million reduction of revenue related to deferred revenue purchase accounting adjustments. The impact of changes in foreign exchange rates was not significant to segment net sales. Net sales declined in all geographic regions.

- GAAP operating loss was $(50.5) million. GAAP operating loss was negatively impacted by a goodwill impairment charge of $41.2 million, which is excluded from segment adjusted EBITDA. Segment adjusted EBITDA increased to $8.0 million, or 5.8% of segment net sales on a combined company basis. Segment adjusted EBITDA was favorably impacted by lower operating costs and favorable product mix despite lower sales.

Full Year 2019 Overview

For comparisons described below for the combined company, the full year 2019 includes historical ARRIS results for the period January 1, 2019 through April 3, 2019 prior to the acquisition on April 4, 2019 and 2018 includes the full year of historical ARRIS results. All historical ARRIS results reflect certain classification changes to align to CommScope’s presentation. Reconciliations of the combined company amounts and reported GAAP results to non-GAAP and adjusted segment results are included below.

Net sales in 2019 of $8.35 billion increased 82.7% year over year primarily due to the contribution of $4.03 billion from the ARRIS acquisition.

On a combined company basis, net sales decreased 13.8% year over year to $9.76 billion, with lower results across all segments and geographic regions. The decrease was primarily due to lower sales to cable operators. Changes in foreign exchange rates negatively impacted net sales by approximately 1%.

GAAP net loss available to common stockholders was $(973.2) million. GAAP net loss was unfavorably impacted by goodwill impairment charges of $376.1 million related to the acquired ARRIS reporting units, as well as $264.2 million of acquisition accounting adjustments (primarily the mark-up of inventory) and $195.3 million of transaction and integration costs, all of which are excluded from non-GAAP adjusted EBITDA.

Non-GAAP adjusted EBITDA increased 42.0% to $1,297.5 million year over year. On a combined company basis, non-GAAP adjusted EBITDA for 2019 decreased by 20.4% to $1,368.2 million and was 14.0% of net sales. Non-GAAP adjusted EBITDA was primarily impacted by lower sales, partially offset by lower material costs and lower operating expenses when compared to the year ago period on a combined company basis.

In 2019, the company generated GAAP cash flow from operations of $596.4 million. Non-GAAP adjusted free cash flow was $792.9 million after adjusting operating cash flow for $210.7 million of cash paid for transaction and integration costs and $89.9 million of cash paid for restructuring costs. Non-GAAP adjusted free cash flow reflects a $78.0 million benefit from certain payments that should have occurred in the fourth quarter of 2019 but were made in the first quarter of 2020.

Outlook

First Quarter 2020 Guidance:

- Revenue of $1.9 billion – $2.1 billion

- Net loss of $(181) million – $(151) million

- Non-GAAP adjusted EBITDA of $180 million – $260 million

- Non-GAAP adjusted effective tax rate of approximately 25% – 27%

- Loss per share of $(0.89) – $(0.88), based on 195 million weighted average basic shares

- Non-GAAP adjusted earnings per diluted share of $0.03 – $0.18, based on 236 million weighted average diluted shares (assuming the if-converted method is applied for our Series A Convertible Preferred Stock)

“Due to the uncertainty regarding the impact of the Coronavirus, we are providing a wider than normal guidance range for the first quarter,” said Alex Pease, Executive Vice President and Chief Financial Officer. “Given that a portion of our raw materials and products are sourced directly from mainland China, and a significant amount of our international shipments are manufactured in China, we are factoring in approximately $60 million of negative impact from the Coronavirus in our first quarter adjusted EBITDA guidance. We are closely monitoring the situation as it unfolds and expect to recover the majority of this impact as the year progresses.”

A reconciliation of GAAP to non-GAAP outlook is included below.

Conference Call, Webcast and Investor Presentation

As previously announced, CommScope will host a conference call today at 8:30 a.m. ET in which management will discuss fourth quarter and full year 2019 results and first quarter 2020 guidance. The conference call will also be webcast.

To participate in the conference call, dial +1 844-397-6169 (US and Canada only) or +1 478-219-0508. The conference identification number is 7454998. Please plan to dial in 15 minutes before the start of the call to facilitate a timely connection. The live, listen-only audio of the call and corresponding presentation will be available through a link on CommScope's Investor Relations page.

A webcast replay will be archived on CommScope’s website for a limited period of time following the conference call.

END

About CommScope

CommScope (NASDAQ: COMM) is pushing the boundaries of technology to create the world’s most advanced wired and wireless networks. Our global team of employees, innovators and technologists empower customers to anticipate what’s next and invent what’s possible. Discover more at www.commscope.com.

Follow us on Twitter and LinkedIn and like us on Facebook.

Sign up for our press releases and blog posts.

Investor Contact:

Kevin Powers, CommScope

+1 828-323-4970

News Media Contact:

Danah Ditzig, CommScope

+1 952-403-8064

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP financial measures enhances an investor’s understanding of our financial performance. CommScope management further believes that these financial measures are useful in assessing CommScope’s operating performance from period to period by excluding certain items that we believe are not representative of our core business. CommScope management also uses certain of these financial measures for business planning purposes and in measuring CommScope’s performance relative to that of its competitors. CommScope management believes these financial measures are commonly used by investors to evaluate CommScope’s performance and that of its competitors. However, CommScope’s use of the terms combined company net sales, non-GAAP adjusted operating income, non-GAAP adjusted EBITDA, combined company non-GAAP adjusted EBITDA, non-GAAP adjusted net income, non-GAAP adjusted diluted earnings per share, non-GAAP adjusted effective tax rate, and adjusted free cash flow may vary from that of others in its industry. These financial measures should not be considered as alternatives to operating income (loss), net income (loss) or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance, operating cash flows or liquidity.

Forward Looking Statements

This press release or any other oral or written statements made by us or on our behalf may include forward-looking statements that reflect our current views with respect to future events and financial performance. These statements may discuss goals, intentions or expectations as to future plans, trends, events, results of operations or financial condition or otherwise, in each case, based on current beliefs of management, as well as assumptions made by, and information currently available to, such management. These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “potential,” “anticipate,” “should,” “could,” “designed to,” “foreseeable future,” “believe,” “think,” “scheduled,” “outlook,” “target,” “guidance” and similar expressions, although not all forward-looking statements contain such terms. This list of indicative terms and phrases is not intended to be all-inclusive.

These statements are subject to various risks and uncertainties, many of which are outside our control, including, without limitation, risks related to the ARRIS acquisition; our dependence on customers’ capital spending on data and communication systems; concentration of sales among a limited number of customers and channel partners; changes in technology; industry competition and the ability to retain customers through product innovation, introduction and marketing; risks associated with our sales through channel partners; changes to the regulatory environment in which our customers operate; product quality or performance issues and associated warranty claims; our ability to maintain effective management information technology systems and to implement major systems initiatives successfully; cyber-security incidents, including data security breaches, ransomware or computer viruses; the risk our global manufacturing operations suffer production or shipping delays, causing difficulty in meeting customer demands; the risk that internal production capacity or that of contract manufacturers may be insufficient to meet customer demand or quality standards; the use of open standards; the long-term impact of climate change; changes in cost and availability of key raw materials, components and commodities and the potential effect on customer pricing; risks associated with our dependence on a limited number of key suppliers for certain raw materials and components; the risk that contract manufacturers we rely on encounter production, quality, financial or other difficulties; our ability to integrate and fully realize anticipated benefits from prior or future divestitures, acquisitions or equity investments; potential difficulties in realigning global manufacturing capacity and capabilities among our global manufacturing facilities or those of our contract manufacturers that may affect our ability to meet customer demands for products; possible future restructuring actions; substantial indebtedness and maintaining compliance with debt covenants; our ability to incur additional indebtedness; our ability to generate cash to service our indebtedness; possible future impairment charges for fixed or intangible assets, including goodwill; income tax rate variability and ability to recover amounts recorded as deferred tax assets; our ability to attract and retain qualified key employees; labor unrest; obligations under our defined benefit employee benefit plans requiring plan contributions in excess of current estimates; significant international operations exposing us to economic, political and other risks, including the impact of variability in foreign exchange rates; our ability to comply with governmental anti-corruption laws and regulations and export and import controls worldwide; our ability to compete in international markets due to export and import controls to which we may be subject; the impact of Brexit; changes in the laws and policies in the United States affecting trade, including the risk and uncertainty related to tariffs or a potential global trade war that may impact our products; costs of protecting or defending intellectual property; costs and challenges of compliance with domestic and foreign environmental laws; the impact of litigation and similar regulatory proceedings that we are involved in or may become involved in, including the costs of such litigation; risks associated with stockholder activism, which could cause us to incur significant expense, hinder execution of our business strategy and impact the trading value of our securities; and other factors beyond our control. These and other factors are discussed in greater detail in Part II, Item 1A, Risk Factors, of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2019, and may be updated from time to time in our annual reports, quarterly reports, current reports and other filings we make with the Securities and Exchange Commission.

Such forward-looking statements are also subject to additional risks and uncertainties related to the recently acquired ARRIS business, many of which are outside of our control, including, without limitation: the risk that we will not successfully integrate ARRIS or that we will not realize estimated cost savings, synergies, growth or other anticipated benefits, or that such benefits may take longer to realize than expected; risks relating to unanticipated costs of integration; the potential impact of the acquisition on relationships with third parties, including customers, employees and competitors; failure to manage potential conflicts of interest between or among customers; integration of information technology systems; and other factors beyond our control.

Although the information contained in this press release represents our best judgment as of the date of this release based on information currently available and reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements, which speak only as of the date made. We are not undertaking any duty or obligation to update this information to reflect developments or information obtained after the date of this press release, except as otherwise may be required by law.