With start of a new year, traditional cable television operators find themselves at the crossroads on how they must redefine their future. The industry is facing several key issues that will drive a new direction for the next generation of operators.

Exponential Growth of Bandwidth Demand

On the positive side of the equation, cable operators are looking at a consumer base that has an insatiable appetite for bandwidth and bandwidth-related services. Everyone wants more—faster:

- Faster Internet access

- More synchronous bandwidth requirements supporting media sharing

- More high-definition video availability

- More channels and video selection options

- More time-shifted video viewing habits

- More devices online using the available bandwidth

A Plethora of Market Competitors

A cable operator can no longer point to the traditional competitors of AT&T, Verizon, Direct TV or Dish as their biggest threats in the market. The cloud has dawned a new era of video providers in the likes of Google, Amazon, Microsoft, Hulu, Netflix and soon Apple. The changing complexion of the competition creates a dilemma for the cable operators.

While the end user is consuming more bandwidth and video than ever before, the operators must now balance the consumer demand for bandwidth versus the cost of bandwidth expansion. When adding more flexible bandwidth to the network serves the competition more than your own company, it becomes a difficult decision to invest. However, not investing creates service issues that result in the loss of even more revenue as customers abandon their network for a competitive network.

So what are the response options?

- Comcast elected to become a content owner/generator when it purchased NBC and its affiliates. Moving upstream in the model allows Comcast to generate revenue from programming no matter how it is delivered.

- A number of companies are trying to hold or grow viewership by acting more like a portal provider with a subscription methodology, allowing viewing premium content through broadcast, time shifted video on-demand, and web-based viewing through an over-the-top video delivery via the Internet. This concept creates challenges that require a more complex back office to manage the content rights and consumer interfaces. It also provides the consumer the ability to view what they want, where they want it, and when they want it.

- Smaller operators struggle with content rights management and cost of content, so they look to monetize their networks through being a bandwidth-pipe supplier. However, can they truly toll enough bandwidth through the network to justify the expense of infrastructure upgrades for additional bandwidth? A question and a challenge that only time will provide the answer.

Develop New Sources of Revenue

As the operators battle for consumer dollars, the focus on revenue growth shifts to new markets and new technologies. As IT departments switch from T1 lines to solutions that deliver increased bandwidth capacity and speeds accommodating innovations such as VoIP, cable operators now have the ability to deploy competitive small- and medium-business services to their customers. The growing demand for wireless bandwidth has also opened up a new market to the cable operators where they can use their extensive and existing infrastructure to backhaul data from the cell sites. Finally, the emerging video processing technology is also generating additional revenue opportunities by allowing operators to insert advertisements into video streams, enabling advertisers to reach consumers through the various video delivery formats. It also allows for targeted advertising.

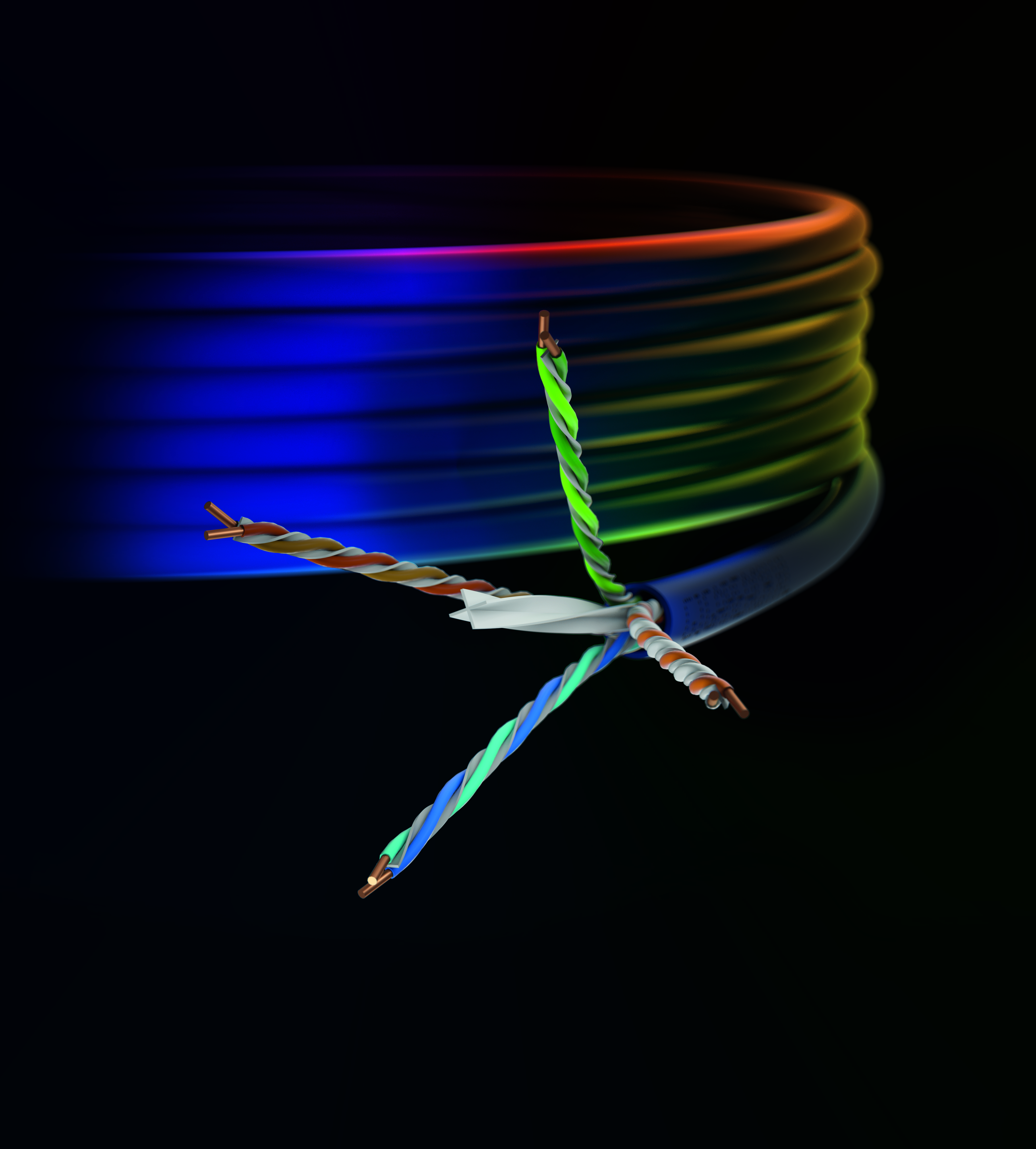

Many cable operators have deployed a reliable HFC network architecture in order to support their customers’ ever-increasing need and thirst for bandwidth. The big question operators must ask themselves in 2013 is how will they elect to monetize and grow this asset. This decision will be vital to their long-term business success.